You’ve made the leap, business is rolling in and one of the first questions usually is - “How much should I be spending on things like my website, advertising, social media, hiring experts, etc.? And also, when should I start doing that? At the beginning? After I have revenue? Take a loan? Use my savings?”

Read MoreThe average American family of 4 spends anywhere between $580 and $1300 on their food budget every month. And if you’re like most families, you spend that and then another $300-$500 eating out. This can often cause waste in the household groceries from the intentions to the actions.

Food is a common place we get caught up in spending….most people are either eating, wearing or driving their retirement, and in this case, I want to talk about when we’re eating it.

Read MoreIt’s officially fall in Western Pennsylvania! The air conditioning has been off for a few weeks, pumpkin flavored everything is in full swing and the cooler temperatures are setting in. And October this year has another benefit for many Americans, a 3rd paycheck.

What most people are inclined to do is pay off large amounts of debt with that extra pay. Was that what you were thinking too?

Read MoreProfit First is a life changing system for any business owner. Not just some, not just new businesses or small businesses or service based businesses or owners who don’t handle money well. Profit First is literally life changing for anyone who fully implements it in their business! Why? I want to dig into that below.

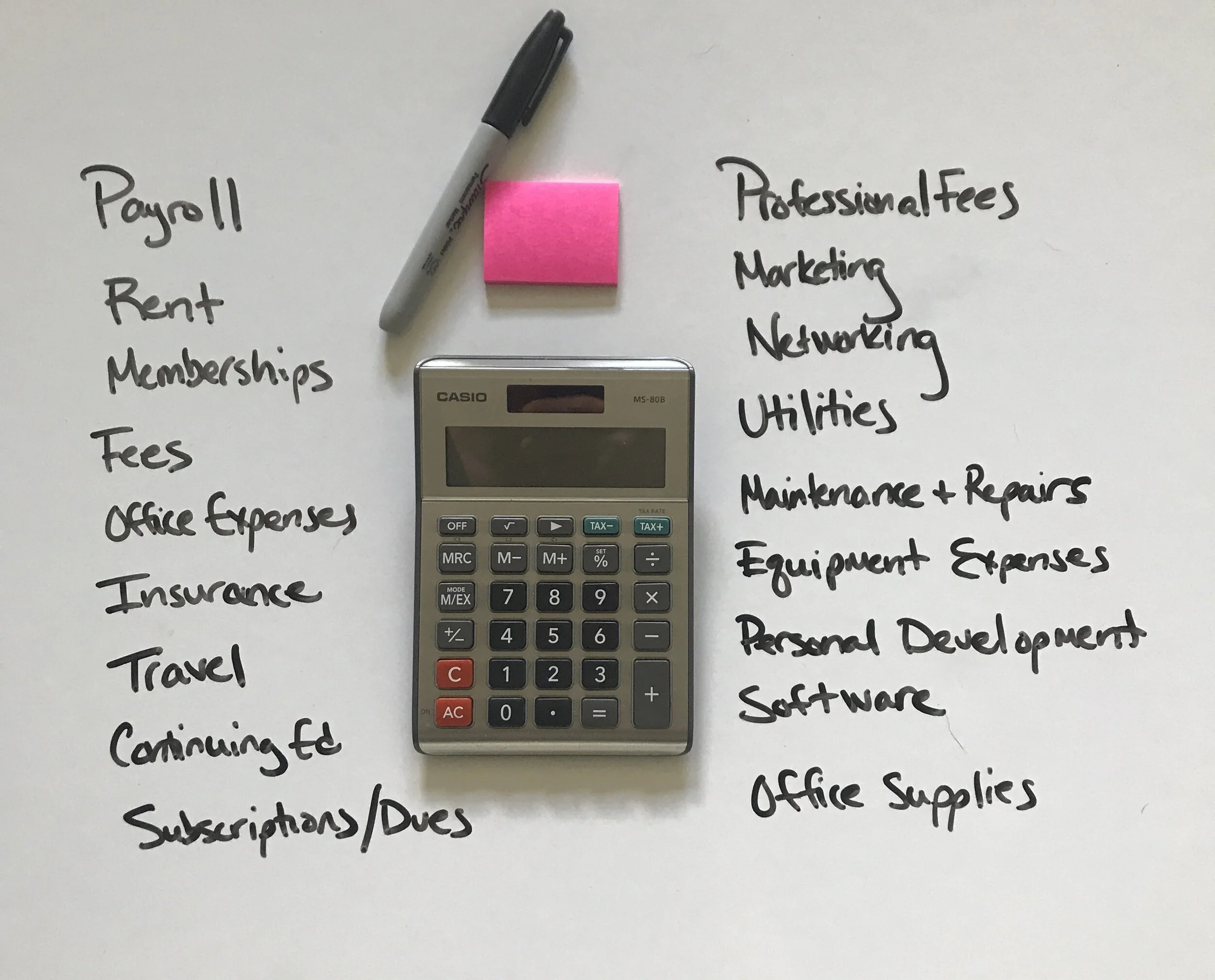

Read MoreWhen you start a business, you don’t realize the one million things that it will require of you. You simply think, I charge money for my service/product that I love and I make money! Voila!

But it doesn’t quite work that way….one of the most important things for business owners to understand and learn to manage is not just their revenue and expenses, but moreso, cash flow. So what is cash flow?

Read MoreI posted a blog today with 8 action steps you should take for the health of your business and your personal finances, but I wanted to go to a few more details specifically for small business owners. I'm not going to beat around the bush, so here they are in no particular order!

Read MoreThere’s not a single person who can say they aren’t affected by Covid-19 in some manner. Whether it’s directly financial, childcare related, health issues, caring for someone else, or something else, it’s affected everyone in some manner or another. Follow these 8 steps to keep your family (and business) financially secure.

Read MoreIf I’ve heard it once, I’ve heard it 100 times. Why would I rent when I can buy and pay less? I can be building equity. I’m throwing my money away by renting.

Read MoreOver and over again, it’s been studied that what everyday millionaires do, is actually quite simple and they’re not who we think they are. So I’ve taken some of the best of the best tips from some ‘everyday millionaires’ and put them together for you.

Read MoreAs parents, we all want only the best for our children, and for our children to have even better lives than we did. I see families on a weekly basis who struggle financially. Take these 7 steps to protect your family and sleep well knowing that they’re covered in case something happens to you.

Read MoreLet’s face it. Asking for a raise is one of the hardest things for most people to do. We’re often afraid we’ll get shut down, be looked at differently, be asked why or make it an awkward situation between you and your boss. I want to share some tips on how to make it less awkward and more powerful.

Read MoreDon’t forget these top 8 items most commonly missed when doing the May budget. And if you’re a lucky winner of the extra paycheck this month, make sure you spend it with intention!

Read MoreCreate your April spending plan now and be prepared by checking out the 9 categories listed below that can easily get overlooked. And don’t forget, budgeting is a team sport if you’re married! Sit down after the kids are in bed with your favorite beverage in hand and make it a plan you both agree on.

Read MoreDid you know that 80% of New Year’s Resolutions fail by February, so by March, they’re pretty much caput. Let’s get your financial resolutions back on the road with your March Budget. Don’t forget all the items below.

Read MoreI know it’s not the most romantic event in your marriage, but sitting down to discuss your family finances and doing a budget together at least monthly is one of the healthiest things you can do for your marriage. It’s critical that we dream together and share common goals so that you’re working tandem to achieve them.

Read MoreIt’s said that a DREAM written down with a date becomes a GOAL. A GOAL broken down into steps becomes a PLAN. A PLAN backed by ACTION becomes REALITY. Think of your budget as your plan. Following your budget will help make your dreams a reality.

Read MoreWe’re all given the same 24 hours in a day, it’s what we do with it that differentiates us. Technology has made so much possible for us, I want you to take advantage of all the opportunities that are out there if you’re looking to kick debt in the face. Listed below are 25 side hustles you can start today, and make up to $1000/month!

Read MoreTraditionally, we all think about toys and gifts when we consider our Holiday budget. But don’t forget these sneaky items as well.

Read MoreNow that you’re married, date nights are more important than when you were dating. This post breaks down budget-friendly date ideas for you and your spouse.

Read MoreThe most important envelope I have was missing for too long

Read More