The traditional concept of working a 9-5 job for approximately forty years until retirement is slowly losing its status as the standard way of living. Many workers are seeking time freedom, early retirement, flexible and remote working conditions, and ultimately, they want their money to work for them (not the other way around). If you want to step outside (or even just supplement) the traditional employment framework, discover our tips for obtaining a side hustle and creating multiple income streams.

Read MoreI recently had a heartfelt conversation with a friend who, with tears in her eyes, shared a significant milestone in her life. For the first time ever, she managed to fund her family’s vacation without resorting to debt.

In previous years, she had been caught in a vicious cycle of racking up credit card debt to fund their trips, only to spend months paying it off just in time for the next vacation.

As I joined in celebrating this meaningful moment with my friend, it prompted a moment of reflection on my own journey and the profound impact of managing finances wisely.

Read MoreIf you find yourself frantically slashing expenses, racking up debt on lines of credit, or worse, dipping into your personal funds just to stay afloat during the off-season, it's time for an intervention. Your finances shouldn't be at the mercy of fleeting trends. You need to take control and implement smarter planning.

Read MoreThe beginning of every new year is filled with a renewed focus on health and wellness: eating better, exercising more, prioritizing mental health, and practicing self-care. All these small changes are important to your well-being, and with commitment, they can help you build a strong foundation for a healthy lifestyle.

The new year is also a great time to focus on financial health and improve your financial wellness. The benefits of financial wellness go far beyond financial stability alone. Financial wellness is a holistic approach to your financial health and brings with it lasting emotional and mental well-being that comes with effective money management.

Read MoreWell-done budgets can be so freeing. They can ultimately take a lot of the fear out of our finances.

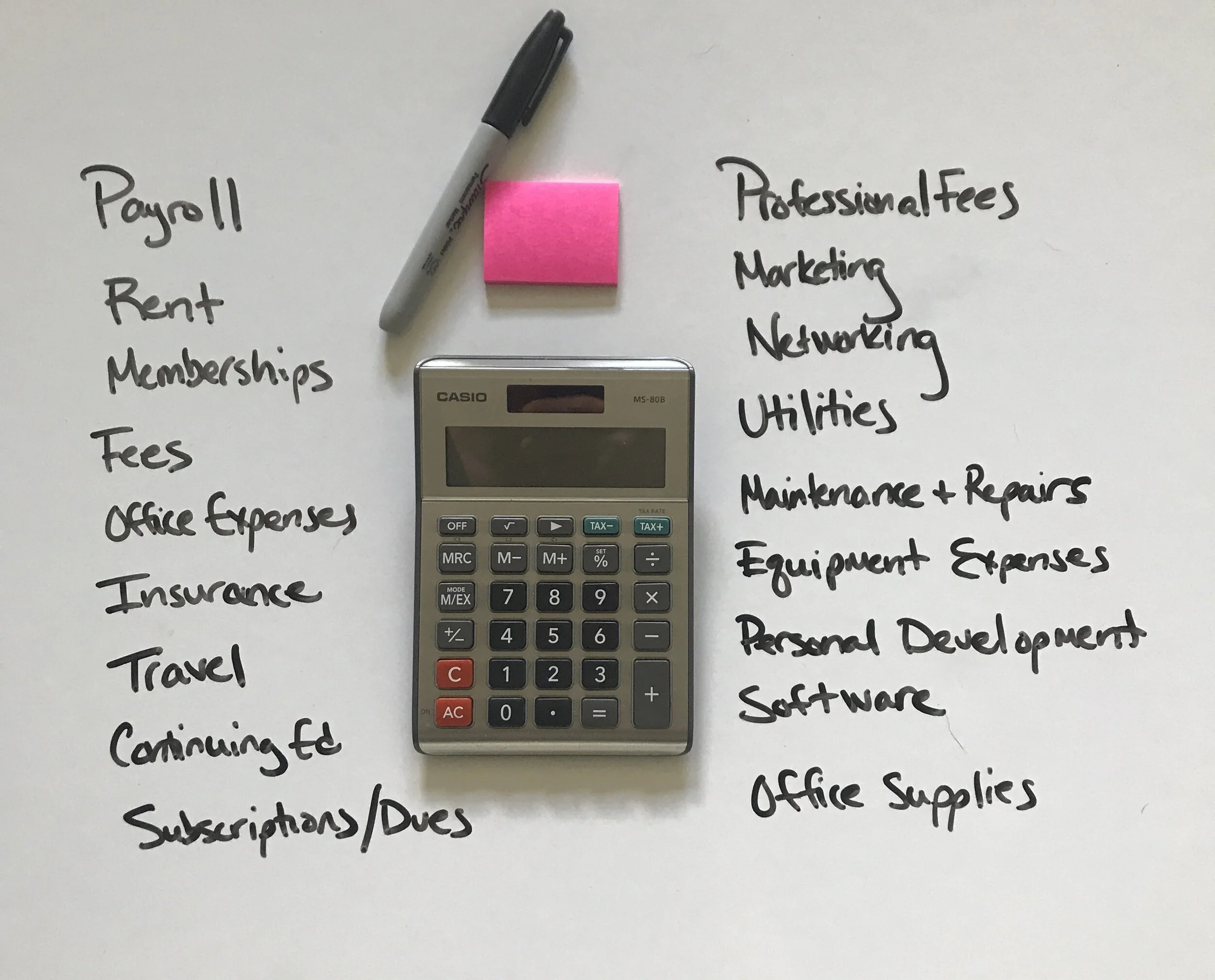

Luckily, creating a budget for your business doesn’t have to be difficult or daunting. I’ve developed a simple five-step guide you can follow to create your own business budget right now and get more clarity on your business finances. Let’s get started.

Read MoreYou’ve made the leap, business is rolling in and one of the first questions usually is - “How much should I be spending on things like my website, advertising, social media, hiring experts, etc.? And also, when should I start doing that? At the beginning? After I have revenue? Take a loan? Use my savings?”

Read MoreThe average American family of 4 spends anywhere between $580 and $1300 on their food budget every month. And if you’re like most families, you spend that and then another $300-$500 eating out. This can often cause waste in the household groceries from the intentions to the actions.

Food is a common place we get caught up in spending….most people are either eating, wearing or driving their retirement, and in this case, I want to talk about when we’re eating it.

Read MoreProfit First is a life changing system for any business owner. Not just some, not just new businesses or small businesses or service based businesses or owners who don’t handle money well. Profit First is literally life changing for anyone who fully implements it in their business! Why? I want to dig into that below.

Read MoreWhen you start a business, you don’t realize the one million things that it will require of you. You simply think, I charge money for my service/product that I love and I make money! Voila!

But it doesn’t quite work that way….one of the most important things for business owners to understand and learn to manage is not just their revenue and expenses, but moreso, cash flow. So what is cash flow?

Read More