It’s a scary thought: common money mistakes can jeopardize your wealth and financial health if left unchecked. But if you can identify and avoid these pitfalls, you can be smart with your money, protect your financial well-being, and work toward building a healthy and secure financial future.

Read MoreA personal emergency fund can act as a savings buffer and help you face the unexpected without taking a significant financial hit. “Saving for a rainy day” and having emergency savings can give you peace of mind and offer financial security through uncertain times.

Just as unforeseen events can disrupt your personal finances, your business can also face unpredictable challenges that threaten its financial stability. It’s crucial to have an emergency fund for your business to help provide a layer of financial security — expecting the unexpected and being financially prepared can help your business survive any challenges that come your way.

Read MoreWell-done budgets can be so freeing. They can ultimately take a lot of the fear out of our finances.

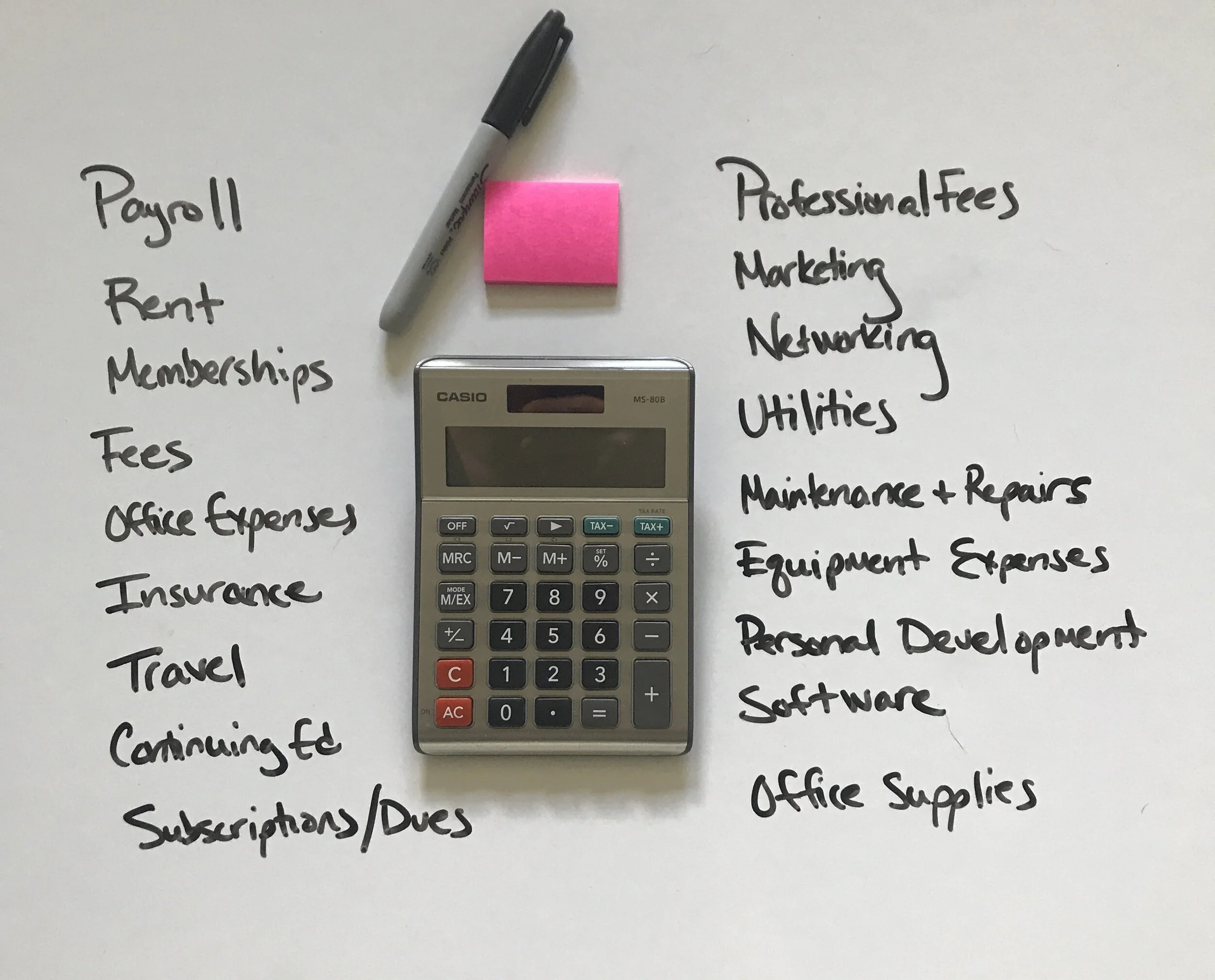

Luckily, creating a budget for your business doesn’t have to be difficult or daunting. I’ve developed a simple five-step guide you can follow to create your own business budget right now and get more clarity on your business finances. Let’s get started.

Read MoreYou’ve made the leap, business is rolling in and one of the first questions usually is - “How much should I be spending on things like my website, advertising, social media, hiring experts, etc.? And also, when should I start doing that? At the beginning? After I have revenue? Take a loan? Use my savings?”

Read MoreThe average American family of 4 spends anywhere between $580 and $1300 on their food budget every month. And if you’re like most families, you spend that and then another $300-$500 eating out. This can often cause waste in the household groceries from the intentions to the actions.

Food is a common place we get caught up in spending….most people are either eating, wearing or driving their retirement, and in this case, I want to talk about when we’re eating it.

Read MoreProfit First is a life changing system for any business owner. Not just some, not just new businesses or small businesses or service based businesses or owners who don’t handle money well. Profit First is literally life changing for anyone who fully implements it in their business! Why? I want to dig into that below.

Read MoreWhen you start a business, you don’t realize the one million things that it will require of you. You simply think, I charge money for my service/product that I love and I make money! Voila!

But it doesn’t quite work that way….one of the most important things for business owners to understand and learn to manage is not just their revenue and expenses, but moreso, cash flow. So what is cash flow?

Read MoreI posted a blog today with 8 action steps you should take for the health of your business and your personal finances, but I wanted to go to a few more details specifically for small business owners. I'm not going to beat around the bush, so here they are in no particular order!

Read More