Saving, finding investors, or taking a loan—how you choose to fund your small business depends on what’s right for you. With a solid financial plan in place, you can allocate your resources wisely, avoid unnecessary debt, and set your business on a sustainable path from the very beginning.

Read MoreMany people try Profit First on their own and hit some major roadblocks. And when it doesn’t work as expected, they’re left scratching their heads, wondering if it’s the system’s fault or theirs.

Here are the top six reasons people fail at the Profit First model on their own—and suggestions for how to dodge these pitfalls like a pro.

Read MoreRemember the old adage; businesses who fail to plan, plan to fail. By completing the steps in this year-end financial checklist, you can rest easy knowing that you’re creating a plan for success. You can’t improve what you haven’t measured, and this checklist will help you measure all the right things for year-end planning and improved forecasting.

Read MoreBoth new and seasoned business owners grapple with this problem every day, so you’re not alone. And luckily, there are things you can do to increase your business profit quickly and (relatively) painlessly!

Read MoreWhen you take the leap from employee to business owner, one of the most important things you need to consider is how you’ll pay yourself. Yet this is one area that new (and even some seasoned) business owners continue to struggle with.

Read MoreEssentially, there are three different professionals who can make your life easier when it comes to your business finances (there are more, but these three are the most common):

A financial business coach

A financial advisor who serves business owners

A bookkeeper or accountant

To choose the right professional for you and your business, you need to know what each professional specializes in, the services they offer, and how they can specifically help support your business financials.

Read MoreWell-done budgets can be so freeing. They can ultimately take a lot of the fear out of our finances.

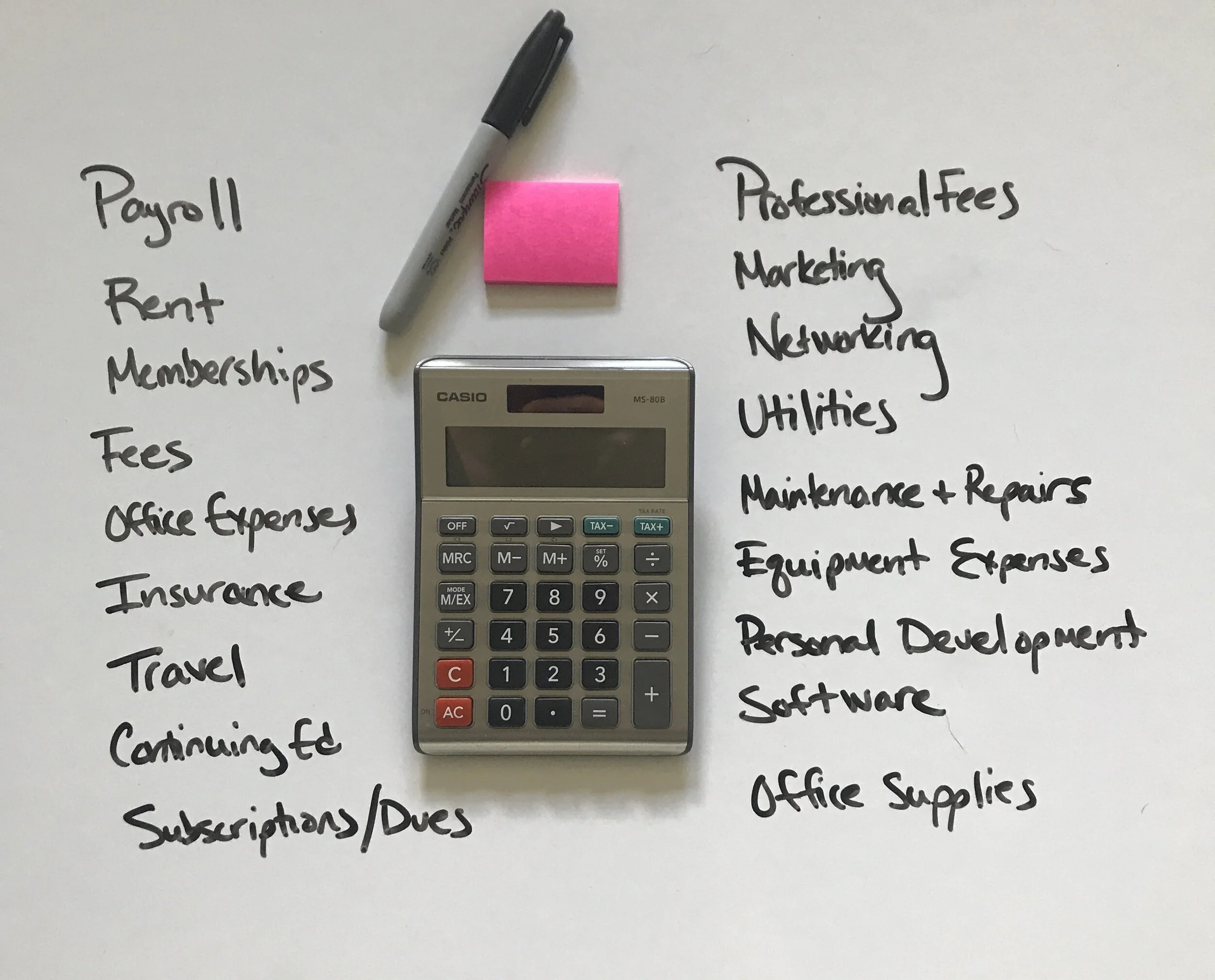

Luckily, creating a budget for your business doesn’t have to be difficult or daunting. I’ve developed a simple five-step guide you can follow to create your own business budget right now and get more clarity on your business finances. Let’s get started.

Read MoreYou’ve made the leap, business is rolling in and one of the first questions usually is - “How much should I be spending on things like my website, advertising, social media, hiring experts, etc.? And also, when should I start doing that? At the beginning? After I have revenue? Take a loan? Use my savings?”

Read MoreThe average American family of 4 spends anywhere between $580 and $1300 on their food budget every month. And if you’re like most families, you spend that and then another $300-$500 eating out. This can often cause waste in the household groceries from the intentions to the actions.

Food is a common place we get caught up in spending….most people are either eating, wearing or driving their retirement, and in this case, I want to talk about when we’re eating it.

Read MoreProfit First is a life changing system for any business owner. Not just some, not just new businesses or small businesses or service based businesses or owners who don’t handle money well. Profit First is literally life changing for anyone who fully implements it in their business! Why? I want to dig into that below.

Read MoreWhen you start a business, you don’t realize the one million things that it will require of you. You simply think, I charge money for my service/product that I love and I make money! Voila!

But it doesn’t quite work that way….one of the most important things for business owners to understand and learn to manage is not just their revenue and expenses, but moreso, cash flow. So what is cash flow?

Read MoreI posted a blog today with 8 action steps you should take for the health of your business and your personal finances, but I wanted to go to a few more details specifically for small business owners. I'm not going to beat around the bush, so here they are in no particular order!

Read More